Shop on credit

Many shops and online stores offer you the opportunity to shop on credit. This means that you receive the goods first and pay later. You will receive either an invoice to pay or an instalment plan stretching over a certain number of months. It is important to know that buying on credit is often more expensive than paying for the goods directly.

You can read more about different types of interest rates and charges on the Swedish Consumers' website.

Ränta och avgifter (in Swedish)

Easy to borrow, harder to repay

It is very easy to get an instant loan today. A few taps on your phone and the money is in your account. Keep in mind that if you don't have the money today, there is a big risk that you won't have it when you have to start repaying the loan.

Don't borrow to pay other loans

Don't take out a new loan to settle other loans – this is often a gateway to long-term debt. Try to solve the problem in a different way.

What does the loan really cost?

If you take out a loan, you need to calculate the full cost of the loan, not just the interest. Expect charges such as arrangement fee and administrative fees. If you take a long time to repay, the loan often becomes expensive. In some cases, it may be necessary to take out a loan, but you need to be aware of the choices you are making.

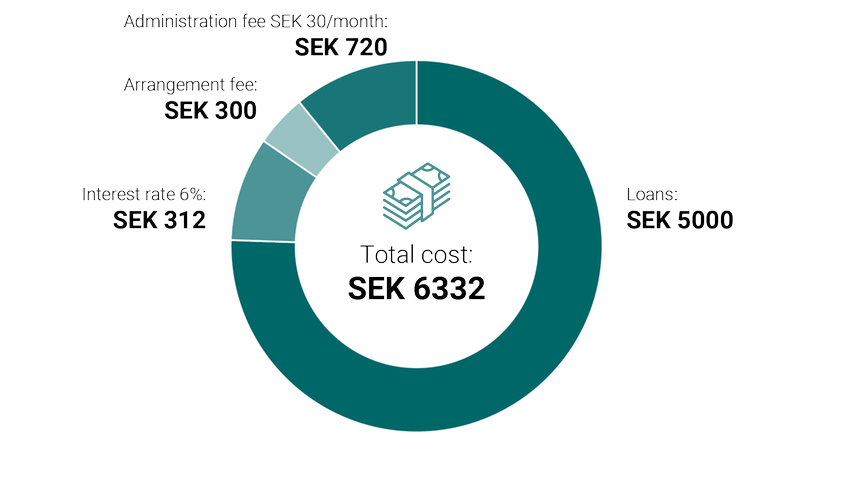

Example of the cost of a loan

You take out a loan of SEK 5 000 to be repaid over two years (24 months). The total cost will then be SEK 6 332. Effective interest rate: 28.72%.

Effective interest rate = The total cost of the loan, expressed as an annual percentage rate.

Enter your data into a loan calculator

The Swedish Consumers' website has a loan calculator, a tool where you can enter your own data. The tool helps you find out how much the loan will cost you in the end.

Student loans and study grants

If you take out a student loan or receive a study grant, and something happens that affects your studies, it is important that you report it to the Swedish Board of Student Finance. This also applies if your income changes or if you have difficulties repaying the loan. You must repay if you have received grants or loans and don't complete your studies as planned. If you cannot pay the full amount at once, contact the Swedish Board of Student Finance as soon as possible to see if you can get an instalment plan to break up the payment.

You can apply to pay less (reduction) if your income decreases while you are repaying your student loans, for example due to unemployment or parental leave. Then, you pay a smaller amount for a time so you can pay your expenses.

Read more about how to report changes and contact the Swedish Board of Student Finance.

Om något händer eller ändras (in Swedish)

Allowances from the Swedish Social Insurance Agency

If you receive allowances from the Swedish Social Insurance Agency, such as housing allowance, parental benefit, or sickness benefit, it is important that you notify us if your situation changes. For example, if you have moved, become a cohabitant, or gotten a new job, you risk receiving too much benefit.

If you receive one or more disbursements in error, you may be liable for repayment. If you don't pay on time, the debt may be sent directly to us for collection. If you are unable to repay the full amount immediately, contact the Swedish Social Insurance Agency and you may be able to split the payment into instalments.

You can read more on the Swedish Social Insurance Agency's website.

Some debts go directly to us

Public authorities and unemployment funds can send certain debts, such as tax liabilities, directly to us. They don't have to apply for an order to pay and wait for us to establish the debt in a decision (verdict). This means that the debts are eligible for immediate recovery.

Joint loans

Sometimes it can feel safe to take out a loan together with someone else. It makes the debt feel half as big. However, if your co-borrower has trouble paying, you may also get into trouble. You need to know that when two or more people take out a loan together, you are usually jointly (jointly and severally) liable. This means that you have a joint responsibility to pay the repayments and interest.

If your co-borrower cannot pay, you will be responsible for repaying the loan. If you have trouble paying, contact the lender as soon as possible. Try to agree on an instalment plan.

Read more about what to consider regarding an instalment plan.

Have you been forced to take out a loan?

Have you been forced or tricked into taking out a loan by yourself or with someone? Then you may be a victim of so-called financial violence. It is important that you act quickly if you cannot pay the loan and receive a claim (order) from us. You can object to the claim and report the coercer to the police.